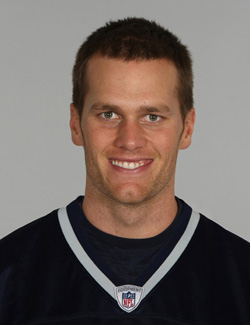

He’s the former president of Ritz-Carlton. He’s just launched his own posh hotel company. And now he’s telling us why he thinks his hotels are going to outluxe all the competition.

Meet Horst Schulze.

Photographs by Sean McCormick.

When was the last time you made a hotel reservation and were asked, “How can we make your stay as wonderful as possible?” If all goes according to plan, that’s exactly what will happen when you call a Capella Hotel to book a room.

Perhaps you’d like to in-line skate in Central Park at midnight? No problem; they’ll arrange it – and send Security along with you.

Do you go absolutely mad for moules marinière? They’ll make it for you – and teach you the recipe, if you wish.

Want to visit Roman ruins, see cave paintings, or tour a banana plantation? They’ll charter a plane. Have the urge to dine in the kitchen of a Michelin three-star restaurant? They’ll call the chef.

And what if you don’t know what you want? “We’ll give you a list of ideas,” says Horst Schulze, Capella’s founder, president, and CEO.

With fewer than 100 rooms at each property, Capella Hotels & Resorts – named for the alpha star of the constellation Auriga – will offer a level of personalized service that few hotels in the world can match, says Schulze. “The staff will operate as if they had a sixth sense,” he proclaims. “From the driver waiting at the airport to the greeting – like you’re arriving at a friend’s estate – to every element of your stay and departure … [like] giving each guest the kind of pillow he wants. You can’t do that in a 300- or 400-room hotel.”

Schulze says that Capella will stand out, even in the rarefied world of superluxe lodging. And while a six-star rating doesn’t exist, that seems to be exactly what he’s shooting for. All Capella hotels will have spas, boutique shopping, and gourmet restaurants; some will have golf courses and/or marinas. Two of the five Capella hotels currently under construction will anchor larger developments that include sole- and fractional-ownership homes and apartments.

But if you can’t afford to stay at a Capella hotel, where room rates will likely match existing suite rates at five-star hotels in the same region, you can still experience lodging Schulze-style: He’s also creating a second “brand,” a company called Solís Hotels & Resorts, designed to appeal to the traditional four- and five-star-hotel guest. Priced “just below the closest competition,” Solís (pronounced so-LEES) will target the same customers as upscale chains such as Four Seasons, Ritz-Carlton, and Fairmont.

Think of it as one brand for the haves … and another for the have-mores.

At press time, Schulze had five Solís hotels in progress and was in negotiations on several more. Capella has five properties under construction, with more in development. But since none of these new hotels is actually up and running yet (the first Solís will open in Chicago in September; the first Capella in Castlemartyr, Ireland, in December), Schulze can only point to his experienced management team, to his track record at Ritz-Carlton, and to the more than $1 billion in investment capital already committed to the company as evidence that there’s no doubt in his mind that both brands will go on to become wildly successful.

“The idea that we won’t succeed is impossible,” he says matter-of-factly. “The only question is how long it will take.”

Industry analysts say Schulze is unveiling the right product at the right time. After weathering the three-year downturn that followed the events of September 11, the hotel industry is hot again, with investors sinking billions into new and existing properties. The trade publications are talking about “record levels of activity,” and it’s the luxury segment of the industry that’s leading the pack.

“The time is right,” concurs R. Mark Woodworth of PKF Consulting, a research firm specializing in the lodging industry. “I definitely believe there’s room for a new hotel player at the highest levels of luxury.”

“Horst has been doing his homework for years,” chimes in Gene Ference, president of HVS/the Ference Group. “He and his executives, many of whom came from Ritz-Carlton, have everything it takes for success.”

And how do Schulze’s competitors feel about all this? One can only guess, because no one’s talking. When asked to comment on Schulze’s plans, the corporate offices at Four Seasons, Mandarin Oriental, Aman Resorts, Le Meridien, Marriott (which now owns Ritz-Carlton), and Ritz-Carlton all said they’d prefer not to comment, other than to say, “We wish him well.” (And some didn’t even say that.)

You can almost see Schulze, who is 65, rubbing his hands together, dying to start getting heads into beds. For the time being, though, he’s traveling the globe (he’s flown close to 500,000 miles in the last three years), calling on banks and investors, and working on real-estate deals.

“Once we have an infrastructure of developers on board,” he explains, “I can go back to actual operations. Right now I’m like a fish out of water. What I love is the daily business, the service. And I love making a profit.”

But he’s careful to qualify that last comment. “Many hotel companies believe the way to make money is by cutting costs,” he says. “I prefer to do it by creating excellence.”

Building a Brand

The seeds for all of this were planted in 2002, when Schulze founded the Atlanta-based West Paces Hotel Group shortly after leaving Ritz-Carlton. He started off by signing management contracts to run existing hotels for their owners, and today West Paces oversees an impressive roster of 11 properties, including the Carefree Resort in Arizona and the Daufuskie Island Resort in South Carolina.

But when Schulze talks excitedly about his plans, what really gets him going are the two brands he’s creating from the ground up. All Solís and Capella hotels will be privately owned – but Schulze and his team will manage them.

Solís Hotels will occupy new as well as existing (but fully renovated) properties. In Chicago, for instance, Schulze and his development partner are spending $125 million to convert the 46-year-old, 39-story Hotel 71 into the Solís Chicago Hotel Condominiums.

“Today there’s a lot of concern about chemicals,” he says. “So all Solís amenities will be organic, and so will much of the food.” When it comes to amenities, he says the hotels will have all the best bells and whistles but will emphasize service amenities, such as on-site activity directors, great bartenders, and greeters (rather than doormen) at the entrance. He’s asked his team of architects and designers to create classic, high-quality interiors designed with comfort foremost in mind.

The Capella experience, on the other hand, will be more about wants than needs. Location is critical to the Capella experience, so Schulze’s team is working triple time to secure its one-of-a-kind settings. The flagship Capella Pedregal in Cabo San Lucas, for example, will perch on a spectacular 24-acre parcel where the Pacific Ocean meets the Sea of Cortez. The two Capellas in Ireland will be built in medieval castles.

“Capella is for travelers who desire enriching experiences and superb service rather than ostentatious displays of consumption,” Schulze says. “It will be elegant but with lots of heart. Elegance without warmth is arrogance.”

Portrait of the Artist as a Young Hotel Man

Born in Winningen, Germany, Schulze was just 11 years old when he announced that he wanted to work in a hotel; never mind that he had never even set foot in one. Three years later, he quit school and went off to be a busboy at a hotel 110 miles from home. His mother warned him to behave, he remembers, because the hotel was fancy, and the guests were “important people.”

Shortly after he started, he had his first life-changing epiphany. “The maître d’ of the restaurant was exceptional in his position,” Schulze remembers. “When he entered the room, you felt it. People felt honored when he came to the table. He was as important to the guests as they were to him. Some see service as menial, but it was clear to me early on that it was an art. I knew from then on … hotels would be my life.”

Schulze’s next seminal experience took place at the Beau-Rivage in Lausanne. “The place was a palace,” he recalls. “Everything about it exuded sophistication: the original art, the huge chandeliers, the painted ceilings, the view of the lake. It made an enormous impression. There was no way I could afford to be there as a guest. Yet, I had the same beautiful things around me. Why not enjoy it?”

Schulze felt the same giddy excitement at the Plaza Athénée in Paris, where the clientele included Gary Cooper and Brigitte Bardot. “My little room was barely as wide as a bed,” he says, “but I was spending my days in the same surroundings as the Aga Khan. It just confirmed for me that I had chosen the right career. And that feeling has stayed with me ever since.”

It was in 1959, while working as a waiter for the Holland America Line, that Schulze got his first glimpse of America. The ship docked in Hoboken, New Jersey, and the crew had a two-day leave. “All my friends ran off the boat, heading for the Empire State Building or Times Square,” he recalls. “I went straight to the Waldorf-Astoria.”

Schulze went on to management positions with Hilton and, later, Hyatt. When he quit in 1983 to join Ritz-Carlton, the company had just three hotels. “My father-in-law called and said, ‘Are you crazy?’ ” Schulze remembers. ” ‘You’re leaving Hyatt for a company with no hotels?’ ” Schulze was named Ritz-Carlton’s executive vice president in 1987 and president and chief operating officer a year later.

The catchy Ritz-Carlton motto – We Are Ladies and Gentlemen Serving Ladies and Gentlemen – may sound like a slogan dreamed up by a slick branding firm, but it’s actually something Schulze wrote in an essay when he was 15, while working as a busboy and attending hotel school once a week.

“It was the only ‘A’ I ever got,” he laughs, “and so of course I remembered it. In this business, we’re not servants; we’re professionals. If you want respect, you have to create excellence.”

Anyone who has ever worked for Schulze knows that “creating excellence” is more than just a motto to him – it’s his raison d’être, his religion.

“If an ashtray was dirty, Mr. Schulze would pick it up himself,” remembers Pascal Bertrand, who was with Ritz-Carlton for 10 years and is now the general manager of the luxurious Legends Resort in Mauritius. “How often do you see the COO doing that? Then he’d bring it up to our office to remind us what it takes to be the best.”

“Few company leaders roll up their sleeves and get involved like Horst does,” agrees Wendy Reisman, who spent eight years with Ritz-Carlton and now runs her own Washington, D.C.-based PR firm. “And few are as motivating. When Horst got up to speak, the entire room sprang to attention.”

At one point in his Ritz-Carlton days, Schulze set out to lure a group of Michelin-starred chefs into leaving their European restaurants and coming to work for him in the United States. One of them was Guenter Seeger. Today, as chef/owner of Seeger’s in Atlanta, Seeger praises Schulze for devotion not only to “heads in beds,” but also to serving the finest food.

“He’s one of the very few hoteliers who has a vision for the culinary part as well,” Seeger says. “If anyone can do a six-star hotel, it would be him.”

In 1999, Schulze and his corporate food-and-beverage director invited their 45 executive chefs and 45 hotel food-and-beverage directors to join them on a whirlwind culinary and wine tour of France and Germany. The eight-day trip was an epic undertaking that involved moving about 90 people and their luggage around Europe; arranging tours, tastings, and vineyard visits; and securing reservations at some of the hardest-to-get-into (and most expensive) restaurants in the world, including many Michelin three-stars. The goal was twofold: to inspire the employees and to reward them for all their hard work.

Schulze was also known for having an almost gurulike effect on his staff and, at the same time, maintaining an approachable, down-to-earth style. “I’ve never known a company president who knew almost every employee’s name,” Reisman says. “And he really, sincerely cares. Horst was totally accessible by phone and by e-mail. He is about as loyal as they come.”

Also legendary was Schulze’s policy that empowered each and every Ritz-Carlton employee – from chambermaid to busboy to corporate VP – to do whatever was necessary to satisfy an unhappy guest. (Schulze says the policy will be the same in his new companies, as well.) As a result, one year, 96 percent of Ritz-Carlton guests surveyed said they would “recommend or repeat” the experience, an unprecedented display of customer satisfaction.

Under Schulze, the company also enjoyed extremely low employee turnover: 24 percent in 2000, compared with 100 percent, on average, for the industry as a whole. So now that Schulze is hiring again, it’s no surprise that he has his pick of the pack.

Hans Van der Reijden, for example, left his management post at the Ritz-Carlton Bali to work for Schulze as the general manager of the Solís Chicago. “I had always envied the people who got to work with Horst creating Ritz-Carlton,” he reports. “Leaving Bali? I didn’t give it a second thought.”

When Schulze left Ritz-Carlton in 2001 to form West Paces, he was responsible for a company with $2 billion in sales. He held a position most hoteliers would be silly to fantasize about, with cash compensation alone estimated at more than $1 million a year.

“It was a beautiful time, but that painting was painted,” he says, explaining why he left the company when he did. “For me, the magic lies in the creation – and I wanted to create. It was time to start a new canvas.”

Whether Schulze creates a masterpiece remains to be seen. But he, of course, is optimistic. “If you do your homework, concentrate on your vision, and stand up when you fall … you will win,” he says. “Nobody would say I don’t know the business. And anyone who knows me knows I’m relentless.”

She was attending

She was attending

Len Oppenheim considers himself a skeptic. So the Wall Street trader can’t say with any certainty whether his headaches came to an end simply because he and his wife, Dena, moved from the suburbs of

Len Oppenheim considers himself a skeptic. So the Wall Street trader can’t say with any certainty whether his headaches came to an end simply because he and his wife, Dena, moved from the suburbs of